Why choose to invest in Malta

Malta is a member of the European Union and the Eurozone from January 1, 2008 and it presents interesting key strengths for foreign investors, like for example its geographic location (which makes it a natural hub for companies seeking to do business with the southern part of Europe and North Africa), a stable political environment, a competitive labour cost (compared to other countries of the European Union), tax benefits and investment, modern infrastructure (the Freeport in Malta serves 115 ports throughout the world, the international airport has direct flights to 37 main cities of the world) and the telecommunications system (wireless Internet, voice over IP, Wimax).

In a recent report, the United Nations have placed Malta in the position of “leader” in the category of countries with a high potential for foreign direct investment. The inflow of foreign direct investment over the past 5 years generally followed an upward trend, reaching more than 10% of GDP.

With a strategic geographic location, situated between Europe and Africa, Malta is positioned today as a strategic exchange node. Indeed, access to markets such as southern Europe or North Africa is very easy through its excellent air and sea links.

![]() The perfect location between East and West

The perfect location between East and West

![]() Unique culture: a wonderful mix of western and estearn history

Unique culture: a wonderful mix of western and estearn history

![]() One of the highest population density in the world: 1300 people/km2

One of the highest population density in the world: 1300 people/km2

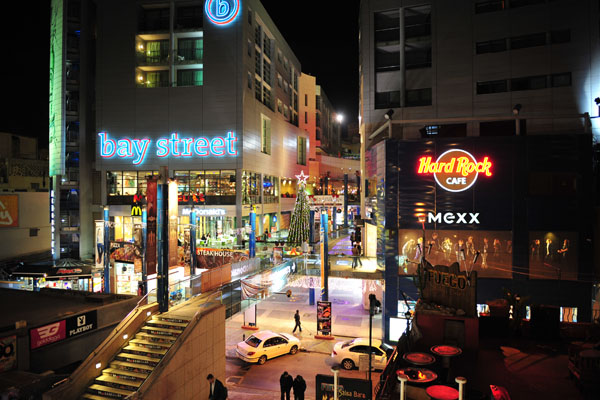

![]() A very important urbanization with beautiful architecture

A very important urbanization with beautiful architecture

![]() Excellent air and maritime communication links

Excellent air and maritime communication links

![]() Steady influx of tourism all year long

Steady influx of tourism all year long

![]() Spectacular year-round climate

Spectacular year-round climate

The measures implemented by the Government

Malta offers advantages in many areas for attracting foreign direct investment, in particular in the areas of production, transhipment and the service industries, including manufacturing of generic pharmaceuticals, information technology and financial services. The Government offers tax incentives for investment in industrial projects:

- Preferential tax rates (5% instead of 35%);

- Investment tax credits (up to 50% of the amount invested or 50% of the first two years of salary of new jobs created);

- Taxes on profits re-invested;

- Stimuli for the creation of jobs;

- Loans with favourable conditions for industrial project proponents;

- Never expiring work permits for shareholders who hold more than 40% of the shares;

In addition, Malta has a free zone, port franc Malta, which offer companies operating in its breast reduced taxation and investment tax credits.

The bilateral investment agreements signed by Malta

Malta has signed bilateral agreements with a dozen countries. At this figure should be added the 24 other countries of the European Union. On the Mediterranean, and outside the countries of the EU, Malta has signed bilateral agreements with France, Libya and Italy. Twelve conventions can be downloaded from the UNCTAD website. They define the framework for the protection of foreign investment in Malta for each of the signatory countries.